World App

A payments (crypto wallet) super app?

Worldcoin Project

Tldr: Near term, Worldcoin and the World App could serve as great solutions for both domestic and cross-border payments. In the long term, the project could potentially help differentiate between humans and AI.

Worldcoin launched the World App a few weeks ago and I think it captures what a crypto wallet experience should be.

Before jumping in to discuss what the World App does, let’s briefly discuss Worldcoin itself.

Worldcoin is a crypto project that was founded in 2020 by Sam Altman, CEO of OpenAI. The company's goal is to distribute a new digital currency to everyone on Earth, and it plans to do this by using a unique iris scanning technology to identify users.

Worldcoin uses a device called the Orb to capture a high-quality image of a person's iris, creating a unique ID for them on their blockchain.

Users receive Worldcoin once identified, with the amount varying based on factors like their location and advocacy for Worldcoin.

Despite privacy concerns related to iris scanning, Worldcoin insists that it only collects necessary data for user identification and is committed to preserving user privacy.

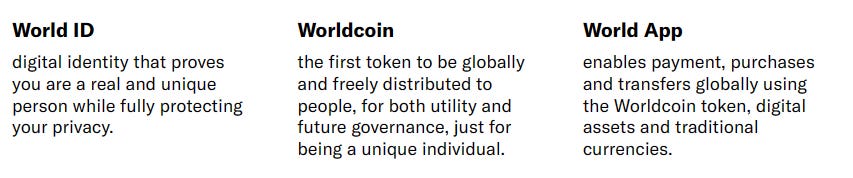

The Worldcoin project appears to have 3 key pillars:

World App can be used independently without subscribing to the initial two parts, ID/Worldcoin. However, if you decide to participate in the iris scan and engage with the first two elements, additional features become available within the app.

World App

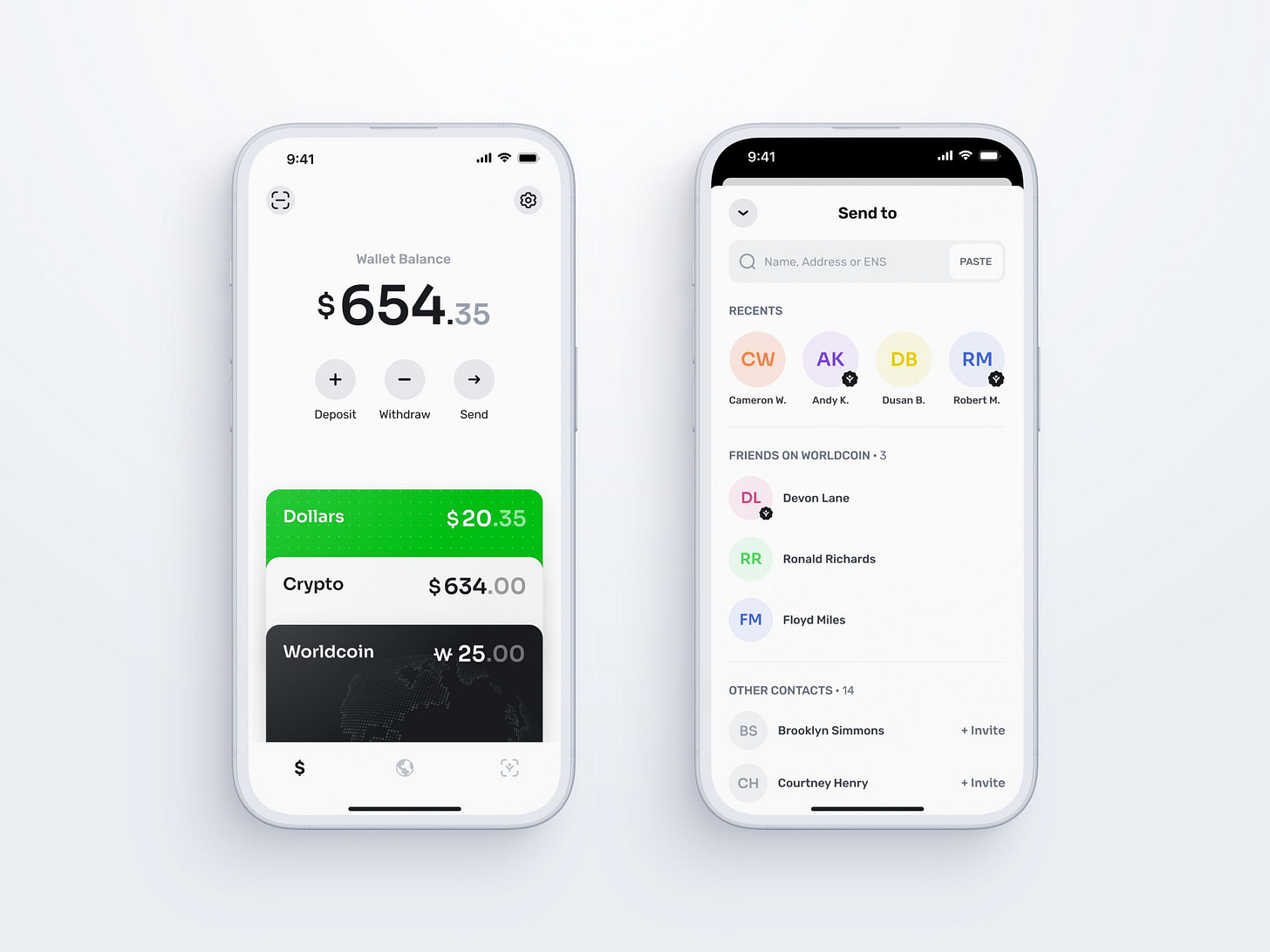

World App is designed to be a simple and user-friendly way to access Worldcoin's digital identity and financial system. The app is currently available on iOS and Android. Most of the functionality within the World App runs on Polygon today, but the project plans to launch and migrate to its own Ethereum roll-up in the future. That said, users barely notice which blockchain underlies their experience.

The app is built to facilitate two primary activities:

The transfer of money (fiat & crypto) between users in any country. Think global Venmo on-chain with on-ramps and off-ramps.

The on-ramps for USD is provided by Ramp and MoonPay. Once you on-ramp from USD in your bank account to the app, the USD is converted to USDC. The recipient needs to have either onboarded to the World App or possess another Ethereum address/wallet.

The off-ramps are still tricky.

If the user wants to take the dollars to their bank account, they need to off-ramp via an exchange. I imagine most users would want to off-ramp directly from the World app to their bank accounts without the intermediate exchange step. I anticipate the World App will address this seemingly minor yet crucial feature in the future.

Hold and trade crypto

Even though many providers facilitate holding and trading crypto, I appreciate the UX simplicity offered by the World App. Most people in the world want to store some % of their net worth in crypto and that’s precisely what is offered here. The Buy / Sell buttons route the transactions through the Uniswap protocol, again without the user realizing what’s running under the hood.

What are some functions enabled if the user chooses to scan their iris and establish their World ID?

Gas-free transactions - I have held a core belief that crypto wallets should give the user Venmo/Cash App user experience parity. Gas free transactions are one primary way to accomplish this.

Peace of mind transfers to verified users - while ENS addresses (.eth names) solve this to some extent, nothing beats knowing an iris scan has verified the user. This is potentially superior to many fintech (non-crypto) super apps available today.

Access learn to earn courses - sure, this can be cool.

Priority for 24/7 chat support in English, Spanish and Portuguese - another key feature that is needed if crypto wallets want their users to custody a meaningful percentage of their net worth in an app. This gets you to bank user experience parity.

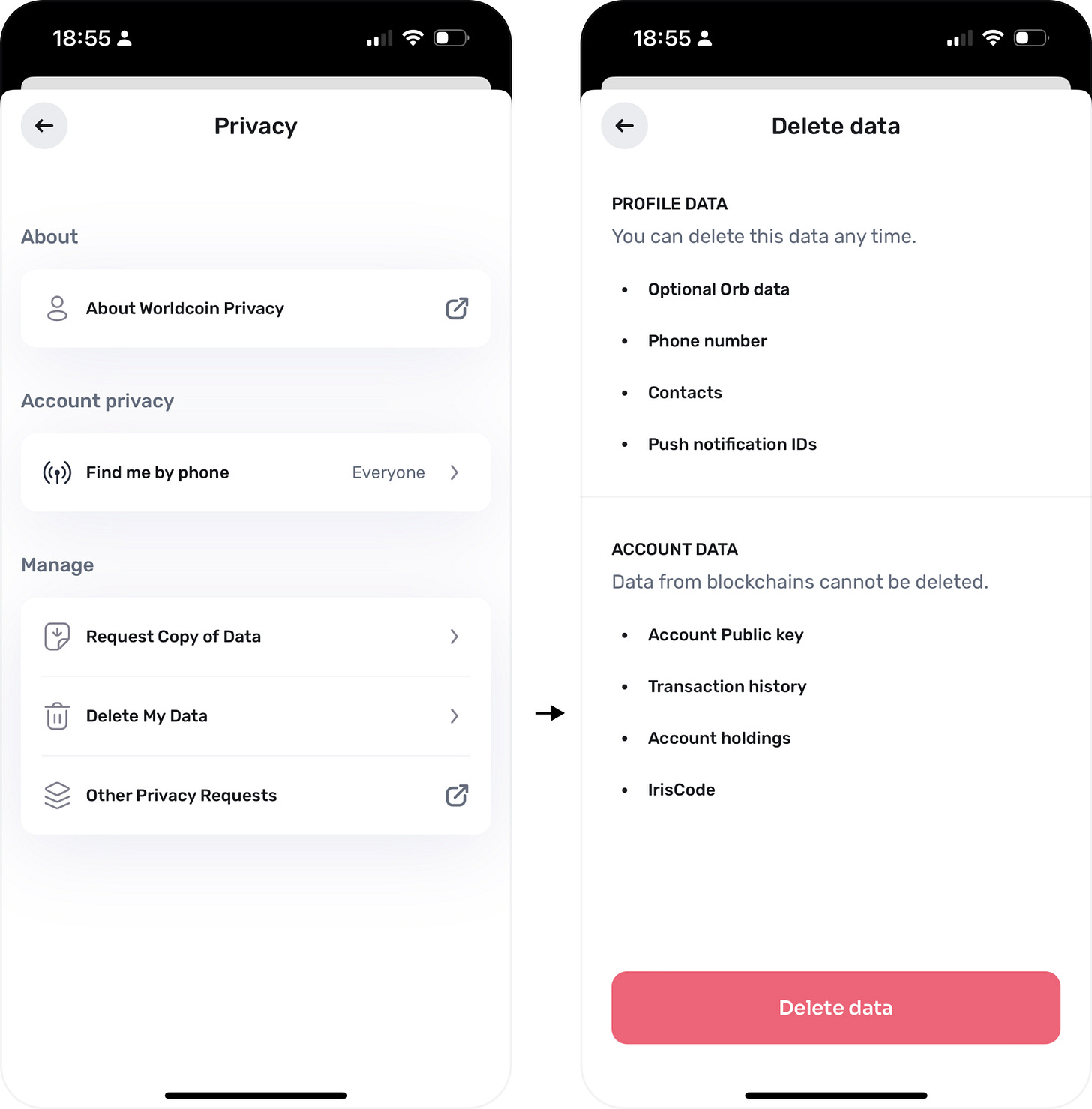

Privacy

The World App is a privacy-focused platform that doesn't require personal information. The app operates as a client for World ID and conducts all required cryptography locally, aligning with the protocol's privacy commitments. Users hold their own World ID and private keys (self-custody), and can choose to back up encrypted keys to Google Drive or iCloud for syncing and recovery.

Users have full control over their data and can delete it easily.

World App adoption short-term - Payments

While I think this is a mass market product, near term adoption is likely skewed towards folks living in regions facing high or hyperinflation and devaluing currencies.

People in these regions want to save their net worth in a combination of USD and crypto.

If I were to isolate countries from the mentioned regions experiencing double-digit inflation and currency devaluation, the total population would exceed 340 million. These countries have an internet penetration rate of over 70% and a combined GDP of more than $3 trillion. In terms of comparison, the total population is comparable to that of the United States, yet their collective GDP constitutes approximately 15% of the US GDP.

These same people don’t want to custody these assets with a centralized intermediary in the local region as those intermediaries can be subject to seizure by the respective governments. For example, Argentina's central bank recently banned payment platforms from offering Bitcoin and other cryptocurrencies to customers. The Central Bank of the Argentine Republic (BCRA) said that the move was necessary to "mitigate risks."

While such actions might pose challenges for Argentinians in converting their local currency into USDC and crypto, they could potentially stimulate the adoption of the World App through the remittance market. According to the world bank, the US-Argentina corridor did about $1bn of transfers in 2022. A significant portion of these transactions consists of sub-$500 transfers, often laden with substantial fees and complexity. The World App, however, can streamline most of these procedures, significantly decreasing both the complexity and the associated fees. While converting this USDC back into local currency can be complicated, this issue could be mitigated if merchants in Argentina start accepting payments in USDC, either through the World App or any other Ethereum wallet.

Stepping away from Argentina, it’s important to realize that the world wide remittance markets are over $750bn in annual received volumes with India, Mexico and China being the largest recipients (source: World Bank). I believe the World App is strategically positioned to initially onboard recipients in these regions, subsequently attracting senders from developed countries as a natural consequence.

World App adoption long-term - Proof of Personhood

I don’t believe it’s a coincidence that Sam Altman (CEO of OpenAI, the company behind ChatGPT) is also the founder and person in charge of leading Worldcoin.

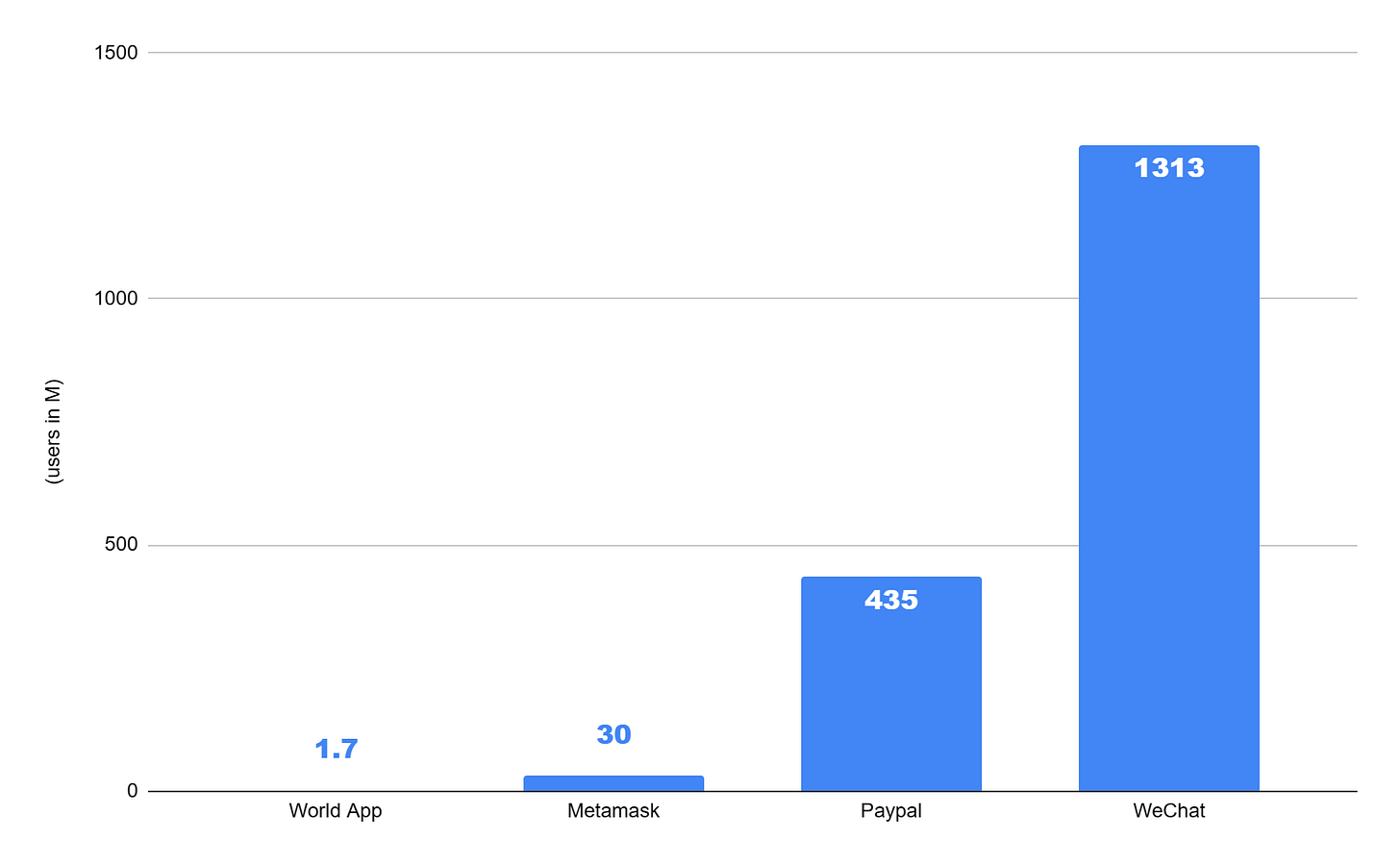

If Worldcoin/ World App successfully scales its user base, matching the size of PayPal with most users subscribing to iris scans (for convenience I outlined above), it has the potential to win the “Proof of Personhood / Decentralized identity” race.

As AI advances, it is becoming increasingly difficult to distinguish between AI and humans online. This highlights the need for authentic human recognition and verification. For instance, I foresee a future in which any individual posting on social media platforms will be required to verify whether the content originated from a human or was created by AI.

While there are many that are tackling this problem, I think the winning solution will be one that prioritizes privacy, self-sovereignty, inclusivity and decentralization. This optimization can only be executed via public blockchains.

Why iris scans over other forms of biometric verification? Here are the trade-offs according to Worldcoin.

World ID is addressing this need by developing an open and permissionless identity protocol. World ID can allow individuals to verify their humanness online while maintaining their anonymity through zero-knowledge proofs.

Conclusion

I've personally tested over 10 self-custody wallets, and I'm impressed with the World App's user experience. I haven't scanned my iris yet as I'm still considering all the trade-offs. If I find myself using the World App on a daily basis, then the benefits of gasless transactions and 24/7 customer service might provide a compelling reason to proceed with the iris scan.

Here is a quick interview I listened to between Laura Shin and Worldcoin co-founder Alex Blania: Worldcoin Launches Native Crypto Wallet - YouTube

DISCLOSURES

Coin Definitions

Bitcoin is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries.

Ethereum (ETH) is a decentralized, open-source blockchain with smart contract functionality. Ether is the native cryptocurrency of the platform. Amongst cryptocurrencies, Ether is second only to Bitcoin in market capitalization.

Uniswap (UNI) is a decentralized exchange built on Ethereum that utilizes an automated market making system rather than a traditional order-book.

Risk Considerations

The information herein represents the opinion of the author(s), an employee of the advisor, but not necessarily those of VanEck or its other employees. The securities/financial instruments/digital assets discussed in this material may not be appropriate for all investors. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

This material has been prepared for informational purposes only and is not an offer to buy or sell or a solicitation of any offer to buy or sell any security/financial instrument, to participate in any trading strategy, or as any call to action. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice.

Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. The actual future performance of any assets mentioned herein is unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data.

Investments in digital assets and Web3 companies are highly speculative and involve a high degree of risk. These risks include, but are not limited to: the technology is new and many of its uses may be untested; intense competition; slow adoption rates and the potential for product obsolescence; volatility and limited liquidity, including but not limited to, inability to liquidate a position; loss or destruction of key(s) to access accounts or the blockchain; reliance on digital wallets; reliance on unregulated markets and exchanges; reliance on the internet; cybersecurity risks; and the lack of regulation and the potential for new laws and regulation that may be difficult to predict. Moreover, the extent to which Web3 companies or digital assets utilize blockchain technology may vary, and it is possible that even widespread adoption of blockchain technology may not result in a material increase in the value of such companies or digital assets.

Digital asset prices are highly volatile, and the value of digital assets, and the companies that invest in them, can rise or fall dramatically and quickly. If their value goes down, there’s no guarantee that it will rise again. As a result, there is a significant risk of loss of your entire principal investment.

Digital assets are not generally backed or supported by any government or central bank and are not covered by FDIC or SIPC insurance. Accounts at digital asset custodians and exchanges are not protected by SPIC and are not FDIC insured. Furthermore, markets and exchanges for digital assets are not regulated with the same controls or customer protections available in traditional equity, option, futures, or foreign exchange investing.

Digital assets include, but are not limited to, cryptocurrencies, tokens, NFTs, assets stored or created using blockchain technology, and other Web3 products.

Web3 Companies include but are not limited to, companies that involve the development, innovation, and/or utilization of blockchain, digital assets, or crypto technologies.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.

i think iris scanning could be their biggest barrier to customer acquisition.